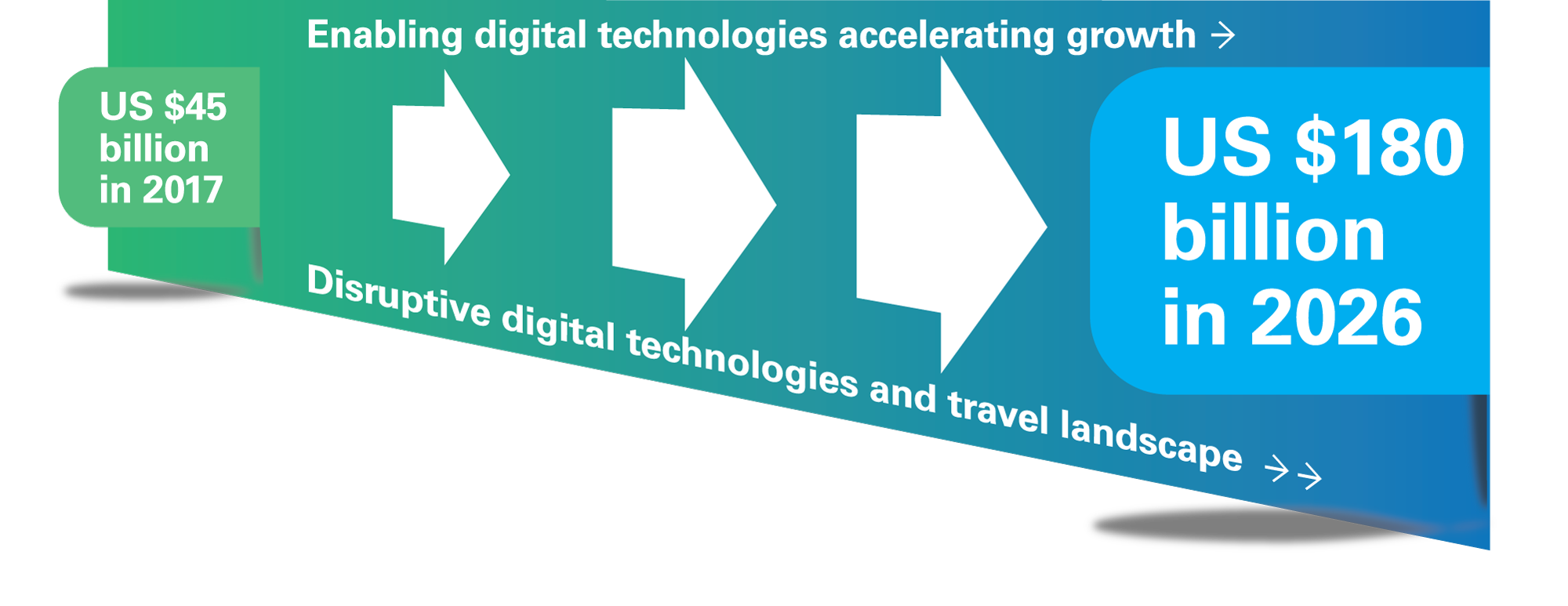

Singapore, 18 October 2018 –The increasing reliance on the internet, social media and smartphones for place discovery and travel bookings by Muslim Millennials and GenerationZ is driving a US$180 Billion online market.

The Mastercard-CrescentRating Digital Muslim Travel Report 2018 (DMTR2018) has revealed insights shaping the growth of online purchases by the next generation of Muslim travelers. The research projects online travel expenditure by Muslim travelers to exceed US$180 billion by 2026.

The DMTR2018 is the first comprehensive report looking at the online travel patterns and attitudes of Muslim travelers across different demographic groups. It extends the research

on the digital Muslim traveler population, as a larger subset of Muslim Millennial Travelers (MMTs) in the Muslim Millennial Travel Report 2017. The Report was released at the Halal-In-Travel Asia Summit Hosted by CrescentRating at ITB Asia 2018.

Fazal Bahardeen, CEO of CrescentRating and HalalTrip, said “The DMTR2018 reveals important online behavior and preferences of Muslim Travelers. It will equip tourism destinations, tour operators, airlines and other tourism and hospitality stakeholders with insights of online platforms and social networking services to evaluate the potential within the Muslim market.”

“With the rapid proliferation of enabling online technologies and payment methods and the rise of Muslim digital natives, as a major segment within the Muslim travel market, the outlook for the digital space is very positive. Destinations need to ensure that their messages reach Muslim travelers through online channels. This report gives the industry a practical and ready segmentation criterion to empathize with different demographics. Digital is real and transcends generations.” he added.

Devesh Kuwadekar, Vice President, Market Development, Mastercard, said, “The Halal travel market continues to be one of the fastest growing travel segments globally, with Muslim visitor arrivals representing about 10 percent of the entire travel industry globally in 2017. Muslim travelers are spending more time online researching and comparing information before they finally choose and pay for their ideal travel experience. Mastercard works with like-minded partners to create tailored offerings for customers across a wide range of passion points. As consumers explore more countries and regions, Mastercard is also seeing an increase in the use of cashless and digital payments through prepaid and debit options as a safer, more convenient and reliable of electronic payments for greater peace of mind when traveling.”

The Mastercard-CrescentRating Global Muslim Travel Index (GMTI) 2018, released in April this year, confirmed that the Muslim travel market will continue its fast-paced growth to

reach US$300 billion by 2026. In 2017, there was an estimated 131 million Muslim visitor arrivals globally. CrescentRating research indicates that more than 60 percent of Muslim

travelers were either millennials or Gen Z.

Top Digitally-Enabled Muslim Outbound Markets

Based on GMTI 2018, the top 30 Muslim Outbound Markets represent 90% of the overall Muslim visitor arrivals. This study looked at the “Digitally Enabled” environment of these

markets to understand the potential of digital transactions. These destinations have been divided into distinctive clusters based on the market size and digital access.

| Cluster A Large outbound markets with a high level of digital enablement |

|

These are regions with large Muslim populations and high per-capita GDP, allows a high percentage of travellers to travel internationally. Majority of the residents in these countries are digital savvy and have the latest digital infrastructures. |

| Cluster B High level of digital enablement but smaller outbound markets |

OIC Countries

Non-OIC Countries

|

These are countries with residents who are digitally savvy and have good infrastructures but the population of Muslim travellers travelling internationally is still small. |

| Cluster C Good level of digital enablement but smaller outbound markets |

|

They have good digital infrastructures but the population of Muslim travellers travelling internationally is still small. |

| Cluster D Emerging growth markets with fast growing levels of digital enablement |

|

They have good digital countries with a growing outbound travel market. Even though they may not have widespread digital infrastructures yet, businesses can look at these markets for medium to long term prospects. |

The full report is available here: https://www.crescentrating.com/halal-muslim-travel-market-reports.html