Since 2012, Crescent Rating has been the leader in evaluating locations for Muslim friendliness. The Mastercard-Crescent Rating Global Muslim Travel Index (GMTI) was created four years after the yearly rankings were changed.

To more accurately reflect the situation of the Muslim travel industry today and assess a destination's travel readiness, we added new and essential components to the GMTI evaluations after pausing in 2020.

In the Mastercard-Crescent Rating Global Muslim Travel Index (GMTI) 2019, Indonesia and Malaysia jointly hold the top rank for the very initial time. The Organization of Islamic Cooperation (OIC) and 130 other locations worldwide are included in the study.

Even though having one of the highest growth rates in the world, the Muslim travel market is still mostly unexplored. The contribution of the Halal travel industry to the world economy is predicted to increase by 34% to US$305 billion by 2025 from US$225 billion in 2021. By then, it is anticipated that there will be 232 million Muslim tourists worldwide, or more than 10% of all tourists.

The GMTI is now the top study offering data and insights to assist nations, the tourism sector, and entrepreneurs in gauging the growth of the travel and tourism sector while measuring a nation's success in accommodating Muslim tourists.

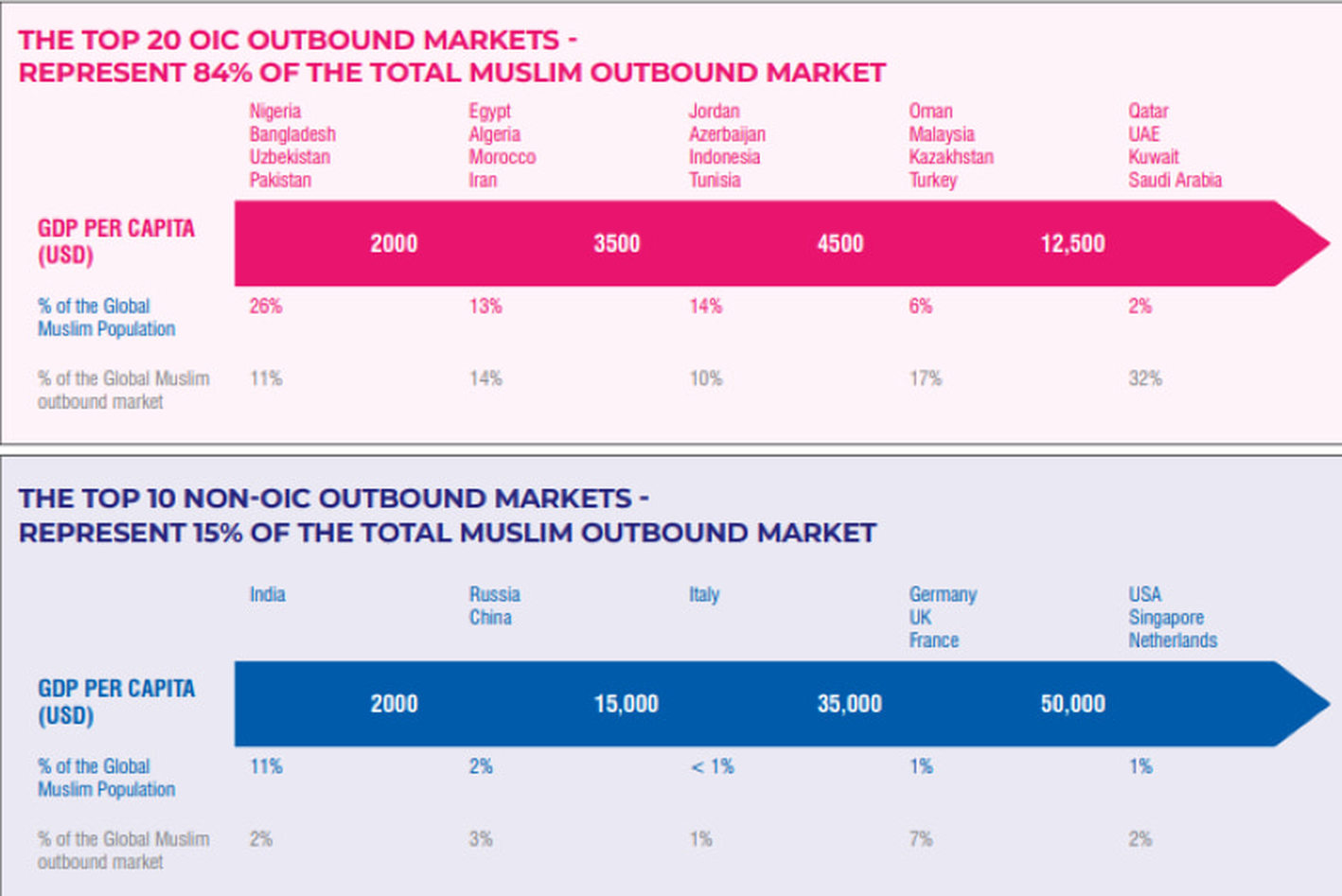

Image Source: Crescentrating

Financials, which stand to gain from interest rate increases, have the highest return potential among corporate bonds with relatively low default risk. In comparison to other market sectors, financial companies have the potential to adapt to more considerable inflation risks.

There is a preference for corporate bonds with ratings of BBB or higher among non-financials; we are wary of bonds with grades of A or higher, which often have longer maturities and are more interest-rate sensitive. Investors should also be careful of businesses with a history of mergers and acquisitions since these businesses may undervalue their bonds for bondholders by changing their capital structures.

The GMTI monitors the accessibility, connectivity, surroundings, and amenities of Muslim-friendly tourism locations and their growth. It is now the top study offering data and insights to assist nations, the travel industry, and investors measure the development of the travel sectors while measuring a country's success in serving Muslim tourists.

By consistently making investments in the tourism, traveling, and hospitality sectors and creating infrastructure that welcomes Muslim tourists, Indonesia has risen to the top of the Index. With a score of 79 on the Index, Indonesia has increased from second to first place with Malaysia. Muslim travelers continue to go to other OIC nations like Turkey, Saudi Arabia, Morocco, Oman, and Brunei. By deliberately utilizing modern technologies to provide services that better attract young, millennial Muslim visitors, these locations can continue to benefit from their naturally Muslim-friendly environments.

However, there is caution with real estate development, albeit this varies widely by industry. Additionally, the Fed's purchases may cause agency mortgage-backed securities to lose their price advantage in 2022.

Emerging markets loans have a massive amount of space to grow this year after trailing in 2021. Central banks in emerging countries have raised rates far earlier than established markets to reduce the danger of inflation. As expected, local emerging-market debt and currencies stand to gain value if inflation stabilizes in 2022.Simply, because international investors will be drawn to the yield, carry, and prospective returns this asset category offers.

As a brief investment product with decent rates and strong credit foundations, collateralized debt obligations will remain attractive. As a result, the price growth of the underlying assets and the borrowers' creditworthiness continue to provide strong support for the housing markets in the United States and Europe.

However, everyone should be cautious about commercial real estate, but this varies widely by industry. Additionally, the Fed's purchases may cause agency mortgage-backed securities to lose their price advantage in 2022.

Download report.